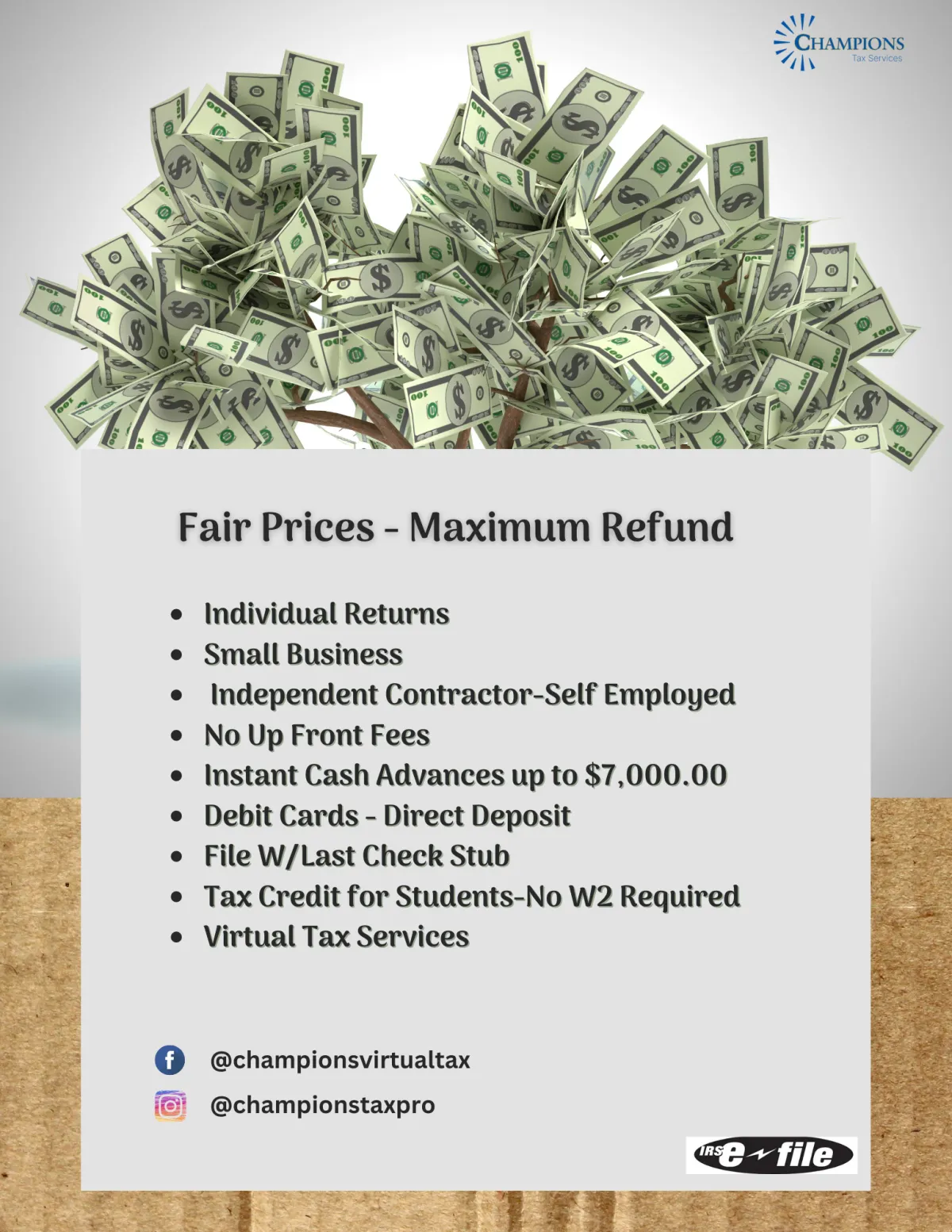

Tax Refund Advance begins Jan 2nd

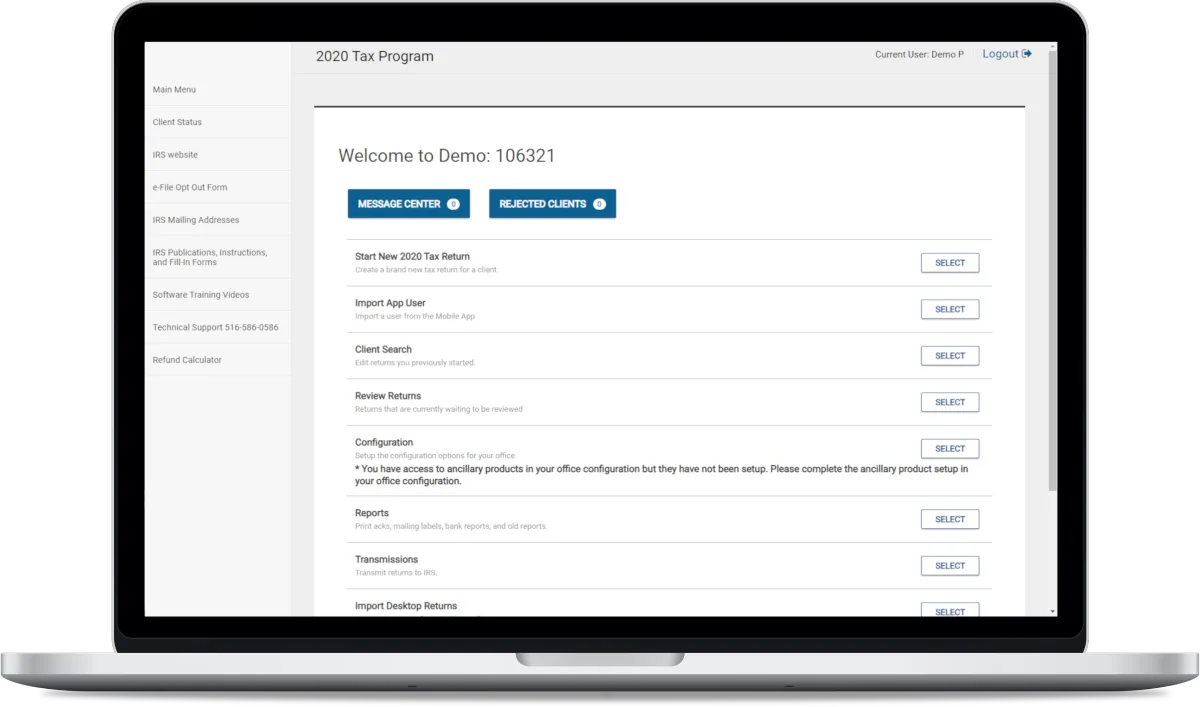

Click Below to Start Your Tax Return and Upload your Docs

Trusted Experts for a Stress-Free Tax Journey

Taxes don’t have to be overwhelming. Our certified tax professionals simplify every step from planning and filing to compliance and savings. We craft personalized strategies that minimize liabilities, maximize deductions, and ensure full alignment with current tax laws and standards.

With our guidance, managing your taxes becomes effortless and transparent. We provide end-to-end support designed to help you keep more of what you earn while staying organized, compliant, and ahead of every deadline.

Smarter Tax Solutions for a Financial Future

Flawless Accuracy

Every seal, every signature, and every document undergoes meticulous scrutiny, ensuring accuracy.

Confidentiality First

Robust security measures and strict confidentiality protocols safeguard your sensitive information.

Flawless Accuracy: Every number, every return, and every document undergoes meticulous checks for 100% compliance.

Where Trust Meets Tax Expertise

Trusted tax guidance, personalized for you. We handle every detail with care, maximize your savings, and help you make smarter financial decisions — year after year.

Attention to every financial detail

Personalized tax strategies that fit your goals

Strict confidentiality and data protection

Clear guidance through complex regulations

Proactive support before, during, and after tax season

4,800 +

Tax Returns Filed Annually

95%

Client Retention Per Year

1,988+

Compliance Cases Managed

97.8%

On-Time Filing Success Rate

Complete Tax & Compliance Solutions for Every Industry

Whether you’re an entrepreneur, employee, or freelancer, our tax specialists tailor strategies that fit your industry’s specific financial and compliance needs.

REAL ESTATE

AGENTS

Optimize property deductions and stay compliant with local and federal laws.

FREELANCER

Streamline reporting, reduce liabilities, and maximize post-tax profits.

EMPLOYEES

Simplify healthcare regulations and manage medical expense deductions efficiently.

SELF-EMPLOYED

Stay audit-ready with precise compliance and transparent documentation.

Tax Strategies That Deliver Real Financial Results

Optimized Returns

Discover hidden deductions and credits.

Reduced Liabilities

Cut unnecessary costs through compliant planning.

Future Compliance

Stay ahead of policy and regulatory changes.

Smarter Filing Systems

Save time and ensure error-free documentation.

Client Trust Showcasing Valuable Testimonials

Our clients’ experiences speak volumes about the accuracy, reliability, and dedication we bring to every engagement. We take pride in building lasting partnerships rooted in trust, transparency, and measurable financial results.

"We switched to their firm last year and saved thousands through smart tax restructuring. Highly professional and reliable."

JOHN DOE

CFO

"They took the time to explain every step. For the first time, tax season wasn’t stressful. It was strategic."

JANE DOE

Entrepreneur

"They cleaned up two years of books, found missed deductions, and set up our quarterly filings, saved us thousands."

JOHN DOE

Owner

my tax preparer Nichole was wonderful & loving she made sure she got me back the max worked over night she was very professional keeps me updated I will be filling again with u guys next year also my experience was very nice I’m really thankful thank u so much.

I've worked with Champions Tax for years and they are by far the best! Very responsive, professional and knowledgeable. Nichole is an expert in this field, she is patient and honest...no gimmicks her! They are great advisors!!! From preparing taxes to many other business ventures, they are by far the best in the business! I highly recommend them!!!

Champions does my taxes every year, it’s always a smooth process and she has great customer service.👍

"Their team handled our filings flawlessly, uncovering major savings. Efficient, expert, and always reliable for our business needs."

"Outstanding service! They made filings stress-free and found savings we never knew existed. Professional and proactive"

Nichole is very knowledgeable and my go to person for all my tax needs. She has mentored me as a tax preparer for over 5 years and I am confident in handling my clients for tax season! If you want to know how to prepare taxes and earn a nice chunk of change during tax season go to Nichole at Champions Realty & Tax Services! Trust me....you will not be disappointed!

Your Reliable Partner for Smart Tax Planning & Strategy

We handle the complexity of tax law so you can focus on your finances with confidence. From quarterly estimates to year-end filings, we create strategies that support growth and compliance, year after year.

Your Guide to Expert Tax Advisory Solutions

Our advisors help individuals and businesses make informed decisions, reduce liabilities, and stay compliant with every tax deadline.

What tax services do you offer?

We provide Personal and Business tax filing and strategic tax planning for individuals and businesses.

Who can benefit from your services?

From freelancers and startups to corporations and non-profits, we tailor our approach to your unique financial situation.

How long does the process take?

Our turnaround time varies by complexity, but most filings are completed within 3–5 business days.

Is there a contract required?

No long-term commitments. You can work with us per project or retain us annually.

What support do you provide post-filing?

We offer ongoing advisory support, audit assistance, and updates on new tax regulations throughout the year.

© Copyright 2025 championstax.com - All Rights Reserved.